Turkey Property Market Trends 2025 — Complete Investment Guide

Discover the key trends shaping the Turkish real estate market in 2025. From Istanbul to Antalya, explore investment hotspots, ROI potential, and expert tips for buyers and investors.

Introduction to the Turkish Real Estate Market in 2025

Overview of Turkey’s Real Estate Landscape

Turkey’s real estate sector has been a dynamic player in the global property market for the last two decades. With its strategic location bridging Europe and Asia, a vibrant tourism industry, and a population of over 85 million, Turkey has been a magnet for investors seeking opportunities in both residential and commercial properties. As we move into 2025, the property market in Turkey is undergoing notable transformations shaped by economic conditions, regulatory shifts, and changing buyer preferences.

The post-pandemic recovery period saw a surge in both domestic and foreign investments. Istanbul, with its blend of modernity and history, continues to attract buyers, while coastal cities like Antalya and Bodrum have carved their niches as hotspots for luxury and holiday homes. Meanwhile, emerging cities like Bursa and Gaziantep are witnessing increased activity, especially from investors looking for affordable yet promising options.

The Turkish government’s policies supporting foreign ownership, combined with the citizenship-by-investment program, have fueled international interest. The Turkish lira's volatility over the years has often created lucrative entry points for foreign investors, although it also carries certain risks. Yet, despite economic fluctuations, Turkey’s property market remains resilient, supported by a strong demand for both housing and commercial space.

Why 2025 is a Pivotal Year for Turkish Property

2025 is shaping up to be a defining year for the Turkish property market for several reasons. Firstly, the stabilization of the Turkish economy after years of fluctuating currency values is likely to build investor confidence. The government has initiated several reforms aimed at attracting sustainable foreign direct investment, especially in the real estate sector. Furthermore, the global shift towards remote work and digital nomadism has increased the appeal of Turkish cities as affordable and culturally rich destinations for expatriates.

This year also marks the culmination of several mega infrastructure projects across Turkey, including new airports, highways, and high-speed railways, enhancing connectivity and boosting regional property markets. The trend of mixed-use developments—blending residential, retail, and office spaces—is gaining momentum, particularly in metropolitan areas.

Moreover, Turkey’s geopolitical position makes it a strategic investment destination amid global economic shifts. With European and Middle Eastern markets facing their own uncertainties, Turkey's role as a bridge is attracting attention from investors looking for diversification.

2025 is not just another year of growth but could be a turning point where sustainable development, technological innovation, and global integration converge in Turkey’s property sector.

Economic Factors Influencing the Turkish Property Market

Inflation and Currency Fluctuations

Inflation has been a double-edged sword for the Turkish economy. On one hand, it has eroded purchasing power for domestic buyers; on the other, it has made Turkish assets more attractive for foreign investors with stronger currencies. In 2025, Turkey's inflation rate shows signs of gradual stabilization due to central bank interventions and fiscal reforms, which is expected to have a mixed impact on the property market.

Currency fluctuations, especially the depreciation of the Turkish lira, have historically allowed foreign investors to acquire property at competitive prices. This trend continues into 2025, albeit with reduced volatility. For buyers from Europe, the Gulf, and even Asia, Turkish real estate remains a bargain compared to their home markets.

However, inflationary pressures have pushed up construction costs, affecting the supply side of the market. Developers are increasingly adopting cost-cutting measures, including smaller unit sizes and streamlined designs, to maintain affordability. Yet, prime properties in sought-after locations continue to command premium prices.

Overall, inflation and currency dynamics are key factors shaping buyer behavior in 2025. While they present opportunities for foreign investors, they also demand careful financial planning and market understanding.

Turkey’s Economic Growth and Impact on Real Estate

Turkey’s economy, recovering from pandemic-induced slowdowns, is expected to post moderate growth rates in 2025. The sectors driving this recovery—tourism, manufacturing, and technology—have a direct correlation with real estate demand. For instance, increased tourism boosts the demand for short-term rentals and hospitality properties, while manufacturing growth drives the need for industrial spaces and worker housing.

The government’s focus on infrastructure development and urban renewal projects also spurs real estate activity. Urban transformation projects, particularly in Istanbul, are revitalizing older neighborhoods, attracting investors interested in redevelopment opportunities.

Moreover, Turkey’s young and growing population continues to support housing demand. With a median age of around 32, the demand for first-time home purchases, rental properties, and affordable housing remains robust. Economic growth translates into increased employment and consumer confidence, both of which fuel the real estate sector.

In summary, the interplay between economic growth and the real estate market in Turkey is expected to remain positive in 2025, offering numerous avenues for both domestic and foreign investors.

Government Policies and Regulations

Foreign Ownership Laws and Incentives

Turkey’s government has long been proactive in promoting foreign investment in its real estate market. In 2025, foreign ownership laws remain liberal, with no significant restrictions for most nationalities. This openness has made Turkey a popular choice for buyers from the Middle East, Europe, and even China.

One of the most significant incentives remains the Turkish Citizenship by Investment Program, which requires a minimum real estate purchase of $400,000. This policy continues to attract investors seeking both a property and a second passport. The process has been streamlined in recent years, making it easier and quicker for applicants.

Additionally, Turkey offers various residency permit options for property owners, further enhancing its appeal. Some municipalities even offer tax incentives and reduced property registration fees to encourage investment.

However, the government is also keen on preventing speculative bubbles. New regulations in 2025 aim to ensure transparency in property transactions and prevent money laundering, including stricter due diligence and reporting requirements for real estate agents and developers.

These policies create a balanced environment where foreign investors are welcomed but within a framework that promotes long-term stability in the market.

Taxation Changes and Their Impact on Investors

In 2025, Turkey has implemented several taxation adjustments affecting property transactions. These include revised property transfer taxes, adjusted VAT rates for certain property types, and new capital gains tax regulations.

Property transfer taxes have been slightly increased to boost public revenues but remain competitive compared to other countries. The Value Added Tax (VAT) on residential properties has been simplified, with exemptions for first-time foreign buyers in specific regions aimed at stimulating international sales.

For rental income, tax rates have been clarified, and online platforms for tax declarations have been introduced, making compliance easier for both domestic and foreign landlords. However, investors need to be aware of the double taxation treaties Turkey has with various countries to avoid paying taxes twice on the same income.

Capital gains tax continues to apply if a property is sold within five years of purchase, although exemptions are available under certain conditions. Understanding these nuances is crucial for investors planning their exit strategy.

In conclusion, while taxation changes in 2025 have slightly increased the cost of transactions, they also bring more clarity and stability, which benefits serious long-term investors.

Demand Trends in Residential Property

Urbanization and Migration to Major Cities

Urbanization in Turkey has been one of the most significant drivers of residential property demand over the past decade—and 2025 is no exception. As rural populations migrate to larger cities in search of better employment, education, and lifestyle opportunities, urban centers like Istanbul, Ankara, and Izmir continue to experience high housing demand.

Istanbul remains at the heart of this urban migration phenomenon. With its unique blend of business opportunities, cultural heritage, and vibrant lifestyle, it attracts not only domestic movers but also expatriates and investors. The city’s diverse districts cater to different buyer segments—from luxury apartments in Nişantaşı and Bebek to more affordable housing in districts like Esenyurt and Beylikdüzü.

Ankara, Turkey’s capital, sees steady demand fueled by government employment and the growing tech sector, while Izmir appeals with its Mediterranean climate, more relaxed pace of life, and emerging business hubs.

Beyond these megacities, smaller yet rapidly growing urban areas such as Bursa, Gaziantep, and Kayseri are emerging as key investment destinations. These cities offer a balance between affordability and urban amenities, attracting both first-time buyers and investors seeking higher rental yields.

In 2025, this urbanization trend is not just about population movement but also about changing lifestyles. Younger buyers and families are seeking modern housing complexes with integrated amenities like parks, fitness centers, and co-working spaces. The concept of community living is gaining traction, influencing both developers' strategies and buyers' preferences.

Moreover, the migration trend is supported by infrastructural developments—new metro lines, highways, and urban renewal projects—which enhance accessibility and property values in these burgeoning areas. For investors, understanding urbanization patterns is crucial in identifying high-growth neighborhoods and making sound investment decisions.

Rise of Luxury Apartments and Villas

Turkey’s luxury property segment is thriving in 2025, fueled by a combination of foreign demand, increasing wealth among domestic buyers, and the allure of premium living standards. Istanbul leads the market with its high-end apartments and penthouses, particularly in areas like Etiler, Levent, and Bosphorus-front districts such as Bebek and Yeniköy.

These luxury properties are characterized by top-notch architecture, state-of-the-art amenities, smart home technology, and breathtaking views. Developers are competing to offer unique features like private elevators, concierge services, wellness centers, and even heliports. Buyers in this segment aren’t just looking for a home—they are buying into a lifestyle.

On the Mediterranean and Aegean coasts, luxury villas in regions like Bodrum, Antalya, and Fethiye are in high demand among wealthy foreigners and Turkish elites. These properties often serve as holiday homes or lucrative vacation rental investments, commanding premium rates during the tourist season.

The citizenship-by-investment program has also significantly impacted this segment. High-net-worth individuals seeking Turkish citizenship often prefer luxury properties that meet the investment threshold while offering long-term value appreciation and rental potential.

Sustainability is another key trend in luxury developments. Eco-friendly designs, energy-efficient systems, and sustainable construction materials are becoming standard in high-end properties, aligning with global luxury market trends and buyer preferences.

In 2025, the luxury real estate market in Turkey is not just surviving—it's setting new benchmarks for quality, exclusivity, and investment potential, making it an attractive option for discerning investors.

Affordable Housing Projects

While luxury properties grab headlines, affordable housing remains the backbone of Turkey's residential property market. The government's emphasis on social housing projects and affordable housing initiatives continues strong into 2025, addressing the needs of the lower and middle-income segments.

Projects spearheaded by TOKİ (Housing Development Administration of Turkey) are pivotal in this regard. These initiatives aim to provide quality housing at reasonable prices, with flexible payment terms designed to make homeownership accessible to more citizens. With thousands of units delivered annually, TOKİ's projects are a critical factor in balancing market demand and supply.

Private developers are also entering the affordable housing sector, often through public-private partnerships, to meet the burgeoning demand. Affordable housing projects typically feature compact units, essential amenities, and community-centric designs, appealing to first-time buyers and young families.

The affordability factor is not solely about pricing but also about financing. Banks and financial institutions have been offering mortgage products with favorable interest rates and terms, encouraging homeownership among Turkey's younger population. Government-backed mortgage schemes and subsidies further enhance the accessibility of these properties.

Moreover, affordable housing is increasingly found in peripheral districts of major cities, benefiting from improved transportation links and urban expansion. As these areas develop, property values tend to appreciate, offering investment opportunities even within the affordable segment.

In summary, the affordable housing sector in Turkey is dynamic, government-supported, and vital for sustaining long-term growth in the real estate market. For investors, it presents an opportunity to tap into a stable demand segment with promising future appreciation.

Commercial Real Estate Trends

Office Space Demand Post-Pandemic

The global pandemic reshaped the way businesses operate, and Turkey's office real estate sector felt its impact deeply. However, by 2025, the commercial property market is witnessing a significant rebound, driven by hybrid work models and the resurgence of in-person business activities.

Istanbul remains the epicenter of Turkey’s office space market, with key districts like Levent, Maslak, and Ataşehir serving as business hubs. The demand for flexible office spaces, co-working environments, and business centers has surged. Companies are looking for adaptable spaces that offer both traditional office setups and collaborative workspaces.

Hybrid work models have changed office space requirements. Firms now seek smaller but higher-quality spaces equipped with advanced IT infrastructure, wellness features, and energy efficiency. Smart offices with touchless technology, high-speed connectivity, and enhanced air filtration systems are in high demand.

Moreover, the government’s initiatives to attract foreign businesses and startups have fueled demand for Grade A office spaces. Business districts in Ankara and Izmir are also seeing increased office space demand, supported by local economic growth and startup ecosystems.

Turkey's strategic location makes it an attractive headquarters choice for regional offices of multinational corporations, especially those operating in the Middle East, North Africa, and Eastern Europe markets. The continued growth of sectors like fintech, logistics, and e-commerce further bolsters the need for modern office environments.

Investors in commercial real estate are adapting by investing in mixed-use developments that combine office spaces with retail and residential components, enhancing the appeal and viability of their projects.

Growth of Retail Spaces and Shopping Malls

Despite the rise of e-commerce, retail spaces and shopping malls in Turkey continue to play a significant role in the commercial real estate landscape. In 2025, retail spaces are evolving rather than diminishing, adapting to changing consumer behaviors and technological advancements.

Shopping malls are transitioning into lifestyle centers—offering not just retail outlets but entertainment, dining, and leisure activities under one roof. This shift is visible in major cities, with malls incorporating cinemas, family entertainment centers, and gourmet dining zones to enhance visitor experiences.

Turkey's strong retail culture, coupled with a young, urban population, sustains high foot traffic in shopping centers. Additionally, tourism remains a significant driver of retail demand, especially in tourist hubs like Istanbul and Antalya, where visitors seek luxury brands, local products, and unique shopping experiences.

Retail properties in mixed-use developments and prime locations command strong rental demand and yield potential. Developers are increasingly integrating technology into retail spaces—offering digital payment solutions, smart fitting rooms, and AI-driven customer services.

For investors, the retail sector in Turkey presents opportunities, especially in emerging districts and cities where new shopping centers are being planned in response to growing urban populations.

Industrial Property and Logistics Centers

The rise of e-commerce, accelerated by the pandemic, has significantly boosted demand for industrial properties and logistics centers in Turkey. By 2025, this sector is one of the most dynamic within the commercial real estate market.

Turkey’s strategic location as a logistics hub between Europe, Asia, and the Middle East gives it a unique advantage. The growth of online shopping platforms, both domestic and international, has created a surge in demand for modern warehouses, distribution centers, and last-mile delivery hubs.

Major logistics corridors around Istanbul, Izmir, and Ankara are hotspots for industrial property investments. Developers are focusing on building state-of-the-art logistics parks with features like automated inventory systems, high-tech security, and easy access to transportation networks.

Government incentives for logistics and industrial investments, along with improvements in infrastructure—such as new highways and upgraded ports—enhance the attractiveness of this sector. Investors are looking at long-term lease agreements with e-commerce giants, logistics firms, and manufacturing companies as stable income-generating opportunities.

Furthermore, the rise of light industrial units within mixed-use developments is a growing trend, allowing businesses to combine production, storage, and distribution in one location, particularly in emerging industrial zones.

For savvy investors, the industrial and logistics real estate sector in Turkey offers promising returns backed by strong demand and favorable economic conditions.

Real Estate Hotspots in Turkey for 2025

Istanbul — The Everlasting Magnet for Investment

Istanbul remains Turkey’s economic and investment powerhouse, maintaining its status as the go-to destination for real estate investors in 2025. The city that never sleeps offers an unbeatable mix of luxury living, high rental returns, and promising growth.

Premium neighborhoods like Nisantasi, Bebek, and Ulus continue to attract high-net-worth buyers seeking exclusive residences with strong appreciation potential. Meanwhile, emerging districts such as Basaksehir, Kartal, and Beylikduzu are rapidly gaining popularity due to major infrastructure developments like Kanal Istanbul and new metro lines.

If you're interested in understanding the real estate market dynamics in Istanbul and exploring district-by-district insights for 2025, this detailed article is a must-read:

👉 Apartment Prices in Istanbul 2025 — Real Estate Trends, District Guide & Investment Tips

Antalya and the Mediterranean Coast

Antalya, often called the tourism capital of Turkey, continues to shine as a prime real estate investment destination in 2025.

With millions of tourists visiting annually, the demand for apartments and villas remains strong, especially in sought-after districts like Lara, Konyaalti, and Belek, known for their stunning sea views and competitive prices.

The booming tourism industry fuels not only the short-term rental market but also property appreciation, making Antalya a top choice for both income generation and long-term investment growth.

For an in-depth look at property prices, key areas for investment, and market analysis in Antalya, don’t miss this insightful article:

👉 Apartment Prices in Antalya 2025 — Where's the Best Place to Buy

Emerging Cities like Izmir and Bursa

While Istanbul and Antalya often steal the spotlight, emerging cities like Izmir and Bursa are quietly becoming favorites among savvy investors in 2025.

Izmir, Turkey’s third-largest city, has been on a growth trajectory fueled by its port, industrial zones, and increasing tech sector presence. Its beautiful coastline, vibrant cultural life, and proximity to popular destinations like Çeşme and Alaçatı make it an attractive location for both living and investment. Districts such as Karşıyaka, Bornova, and Alsancak are seeing heightened demand for residential properties, particularly among young professionals and families.

Izmir also benefits from significant infrastructure investments, including highway projects and the expansion of its metro system, improving connectivity and driving real estate values. Its reputation as a liberal, cosmopolitan city adds to its appeal among local and international investors.

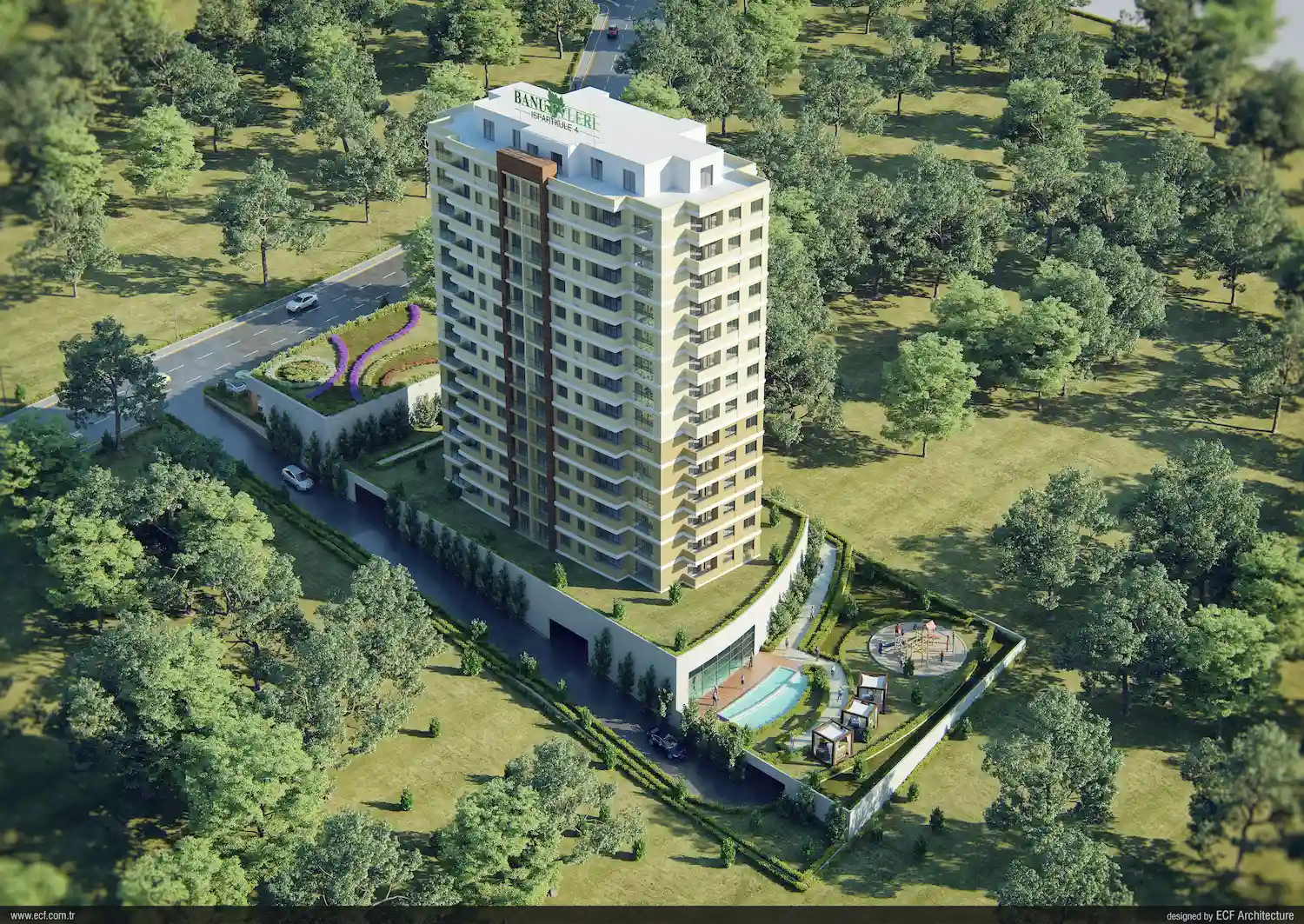

Bursa, historically known for its textile industry, is emerging as an affordable yet promising real estate market. Located close to Istanbul and connected by ferry and highway, Bursa offers a mix of industrial, commercial, and residential investment opportunities. The city’s growing economy, combined with its scenic setting at the foothills of Mount Uludağ, attracts both investors and those seeking a quieter alternative to Istanbul.

Developers are responding to this demand with new residential complexes, mixed-use developments, and industrial zones designed to cater to the city’s growing population. In 2025, Bursa stands as a smart choice for investors looking for growth potential in a less saturated market.

Technology’s Role in the Turkish Property Market

PropTech Innovations and Digital Platforms

In 2025, technology is revolutionizing the Turkish property market in ways previously unimaginable. PropTech—property technology—has become a significant driver of efficiency, transparency, and convenience in real estate transactions.

Digital platforms for buying, selling, and renting properties have become mainstream. These platforms offer detailed listings, virtual tours, digital paperwork, and even AI-powered property recommendations, making the property search process more accessible and user-friendly. Turkish companies are innovating rapidly in this space, and global PropTech firms are also entering the market, drawn by its growth potential.

Blockchain technology is emerging in real estate transactions, providing secure and transparent property records, smart contracts, and even tokenized property investments. This technological shift enhances trust among investors, particularly foreign buyers wary of transactional complexities.

AI-driven analytics tools help investors analyze market trends, forecast property values, and identify high-growth areas, giving them a competitive edge. Property management platforms equipped with smart systems allow landlords and property managers to handle leases, payments, and maintenance requests efficiently.

Developers and real estate agencies are also leveraging digital marketing strategies—SEO, social media campaigns, and targeted ads—to reach a broader audience, including international buyers. The shift towards digital transformation is making the Turkish property market more inclusive, transparent, and globally connected.

Virtual Tours and Online Transactions

Virtual tours and online transactions have moved from being a novelty to a necessity in the Turkish property market by 2025. The pandemic accelerated the adoption of these tools, and now they are an integral part of the buying process.

Prospective buyers, especially those from abroad, can take 360-degree virtual tours of properties, explore neighborhood surroundings, and even conduct live video walkthroughs with agents—all from the comfort of their homes. This convenience has significantly shortened the property decision-making cycle and broadened the reach of Turkish developers and agencies.

Online platforms offer end-to-end transaction services, including digital contract signing, online payments, and property registration. These innovations eliminate geographical barriers and streamline the buying process for both local and international buyers.

Virtual reality (VR) and augmented reality (AR) tools are also making their mark, particularly in off-plan property sales. Buyers can now experience fully immersive property tours of projects still under construction, helping developers boost pre-sales and reduce marketing costs.

In 2025, these technological advancements are not just trends but permanent fixtures that enhance the efficiency and appeal of investing in the Turkish property market.

The Rise of Sustainable and Green Developments

Eco-Friendly Housing Projects

Sustainability has taken center stage in the global real estate market, and Turkey is no exception. In 2025, eco-friendly housing projects are on the rise, driven by both consumer demand and government incentives.

Developers are increasingly adopting green building practices, including the use of sustainable materials, energy-efficient designs, and renewable energy sources. Solar panels, rainwater harvesting systems, and high-efficiency insulation are becoming standard features in new housing projects.

Eco-conscious buyers are seeking properties that not only minimize environmental impact but also reduce utility costs over the long term. This shift is evident in both luxury and affordable housing segments, with developers highlighting sustainability as a key selling point.

Government initiatives play a significant role in promoting green developments. Incentives such as tax breaks, subsidies for renewable energy systems, and streamlined permitting processes encourage developers to adopt eco-friendly practices. Certification programs like LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) are gaining traction, adding value and credibility to sustainable projects.

The rise of green neighborhoods and eco-communities in cities like Istanbul, Ankara, and Izmir showcases how sustainability is reshaping Turkey’s urban landscape. These projects often feature green spaces, communal gardens, and pedestrian-friendly designs, promoting healthier and more connected communities.

For investors, sustainable properties offer long-term value appreciation, reduced operational costs, and alignment with growing global demand for responsible investments.

Government Incentives for Sustainable Construction

The Turkish government’s commitment to sustainable construction is more evident than ever in 2025. Through a combination of financial incentives, regulatory reforms, and awareness campaigns, authorities are encouraging both developers and buyers to embrace green building practices.

Key initiatives include:

Tax reductions for developers who meet specific sustainability criteria.

Subsidies for installing renewable energy systems like solar panels.

Expedited approval processes for eco-friendly construction projects.

Grants and low-interest loans for residential and commercial green developments.

Public-private partnerships are also on the rise, with government agencies collaborating with private developers to create sustainable urban projects. These partnerships often result in mixed-use developments that prioritize green spaces, energy efficiency, and community engagement.

In addition to direct financial incentives, the government is enforcing stricter building codes related to energy efficiency, water conservation, and waste management. These regulations ensure that even conventional construction projects meet minimum environmental standards.

Investors in sustainable properties benefit from higher tenant retention, reduced vacancy rates, and often premium rental yields, as sustainability becomes a key consideration for both residential and commercial tenants.

By 2025, Turkey’s real estate market is not just adapting to sustainability—it’s embracing it as a core component of development and investment strategy.

Impact of Global Geopolitical Factors

Foreign Investment Trends

Turkey's strategic geopolitical location—situated at the crossroads of Europe, Asia, and the Middle East—has always made it a focal point for foreign investment. In 2025, this significance is even more pronounced as shifting global alliances, trade routes, and regional economic strategies reshape investment patterns.

Foreign investors, particularly from the Gulf Cooperation Council (GCC) countries, Europe, and increasingly Asia, see Turkish real estate as a stable and attractive investment. The allure stems from a combination of competitive property prices, high rental yields, and the potential for capital appreciation. Furthermore, Turkey’s citizenship-by-investment program continues to be a powerful magnet, especially for investors from politically unstable regions looking for residency and mobility benefits.

China's Belt and Road Initiative (BRI) also plays a subtle yet impactful role. With Turkey being a significant node in this trade network, Chinese investors are exploring Turkish real estate—not only residential but also logistics hubs, industrial parks, and commercial centers.

Additionally, strained relations between certain countries and the European Union have pushed investors to consider Turkey as an alternative base for accessing European markets. Istanbul, in particular, has become a regional hub for businesses and investors seeking a gateway to both European and Middle Eastern markets.

Currency fluctuations, while a challenge for domestic buyers, create favorable entry points for foreign investors with stronger currencies. These factors combined make Turkey an essential player on the global real estate investment stage in 2025.

Real Estate as a Safe Haven Asset

In times of geopolitical and economic uncertainty, real estate often emerges as a preferred safe-haven asset—and Turkey is no exception. The Turkish property market in 2025 serves as a shelter for investors looking to preserve capital amidst global volatility.

The real estate sector’s tangible nature and its intrinsic value offer a sense of security that stocks, cryptocurrencies, or other volatile assets often lack. For investors from regions affected by conflict or economic instability, Turkish real estate provides both a financial refuge and a potential second home.

Istanbul’s prime real estate, Antalya’s coastal villas, and even commercial properties in Izmir are increasingly viewed as secure assets that can hedge against inflation and currency depreciation. The demand for such safe-haven assets drives competition, particularly in the luxury and high-end segments, leading to healthy capital growth.

Moreover, Turkey’s historical resilience in bouncing back from economic or political challenges adds to its appeal. Investors value the market’s long-term prospects, knowing that despite occasional turbulence, Turkish real estate tends to maintain or recover its value effectively.

In 2025, with global financial markets facing numerous uncertainties, Turkey’s property market stands firm as a reliable, income-generating, and appreciating asset class for both local and international investors.

Short-Term Rentals and Tourism’s Influence

Growth of Airbnb and Vacation Rentals

The global rise of short-term rental platforms like Airbnb, Booking.com, and Vrbo has profoundly impacted Turkey’s real estate sector. By 2025, this trend is deeply ingrained in key tourist cities such as Istanbul, Antalya, Bodrum, and Fethiye.

Investors are increasingly purchasing properties specifically for short-term rental purposes. The returns on vacation rentals, especially during peak tourist seasons, far exceed those of traditional long-term leases. For example, a well-located apartment in Istanbul or a seaside villa in Antalya can generate monthly rental incomes that are significantly higher than long-term residential rentals.

The flexibility offered by short-term rentals attracts both property owners and tenants. Owners benefit from higher income potential and the ability to use their property personally when desired. Tenants enjoy the convenience of home-like accommodations with the amenities of a hotel.

However, success in the short-term rental market requires more than just owning a property. Investors must consider factors like property management, maintenance, marketing, and compliance with local regulations. Professional property management companies have emerged to fill this niche, offering turnkey solutions for investors.

The rise of digital nomadism and remote work further boosts demand for short-term rentals. Turkey's relatively low cost of living, vibrant culture, and favorable visa policies make it an attractive destination for digital nomads, expanding the short-term rental market beyond just holidaymakers.

Regulatory Framework for Short-Term Leases

While short-term rentals present lucrative opportunities, they also come with regulatory challenges that investors must navigate. In 2025, the Turkish government has introduced clearer guidelines and regulations aimed at balancing the interests of property owners, tenants, and the local community.

Key regulations include:

Registration requirements for short-term rental properties with local municipalities.

Licensing obligations for landlords engaging in commercial short-term rentals.

Taxation policies ensuring rental income is declared and taxed appropriately.

Zoning restrictions in certain areas to control the concentration of short-term rental units.

These measures aim to protect the housing supply for local residents, prevent overcrowding in tourist areas, and ensure fair taxation. For investors, understanding and complying with these regulations is crucial to avoid fines, legal complications, and operational disruptions.

Despite regulatory tightening, the short-term rental market remains a profitable segment when approached professionally and legally. Investors who adapt to the new rules, employ proper management strategies, and maintain high property standards can continue to capitalize on the booming tourism and short-term rental demand in Turkey.

Challenges Facing the Turkish Property Market

Political Instability and Market Risks

Like any emerging market, Turkey’s real estate sector faces its share of risks, many tied to political dynamics. While the country has shown remarkable resilience, political instability remains a concern for investors, especially those unfamiliar with the local landscape.

In 2025, regional conflicts, shifting alliances, and domestic political shifts pose challenges that can affect investor sentiment. Changes in government policies, sudden regulatory adjustments, and fluctuations in international relations may impact property prices, foreign investment flows, and market stability.

Investors must conduct thorough due diligence and stay informed about the political climate. Partnering with reputable local agents, legal experts, and financial advisors can help mitigate risks and navigate the complexities of the Turkish property market.

Moreover, Turkey’s proximity to volatile regions sometimes affects investor confidence, although this is often balanced by the country’s strong military, diplomatic ties, and proactive economic measures. While political risks are real, they are part of the broader risk-reward equation that characterizes emerging markets like Turkey.

Prudent investors approach the market with a long-term perspective, understanding that while short-term fluctuations may occur, Turkey’s real estate sector has historically demonstrated strong recovery and growth potential.

Supply Chain Issues and Construction Costs

Another challenge confronting the Turkish property market in 2025 is the global supply chain crisis, which has affected construction materials, labor costs, and project timelines worldwide. Turkey is no exception.

The rising cost of building materials—especially steel, cement, and imported finishes—has driven up construction expenses, forcing developers to either increase property prices or scale back on certain project features. This dynamic puts pressure on profit margins and can delay the delivery of new housing units.

Labor shortages, partly due to migration and changing employment patterns, add another layer of complexity. Developers often struggle to find skilled workers at reasonable costs, affecting both construction quality and timelines.

Government interventions, such as subsidies for domestic production of key materials and vocational training programs, aim to alleviate some of these pressures, but the challenges persist.

For buyers and investors, these factors translate into higher property prices, especially in the new-build market. However, they also create opportunities in the secondary market, where existing properties become more attractive due to immediate availability and potentially lower prices.

Understanding the impact of supply chain dynamics and construction costs is essential for making informed investment decisions in Turkey’s real estate market in 2025.

Opportunities for Investors in 2025

High-Yield Rental Opportunities

Turkey's real estate market in 2025 presents abundant opportunities for investors seeking high rental yields, especially in strategically located properties across key cities and tourist hotspots. The country’s diverse rental market—ranging from long-term residential leases to short-term vacation rentals—offers investors flexible options based on their investment goals.

In metropolitan cities like Istanbul, Ankara, and Izmir, demand for long-term residential rentals remains strong. Istanbul, with its ever-growing population and influx of professionals and students, continues to offer attractive rental yields, particularly in districts like Kadıköy, Beşiktaş, and Şişli. Properties near business hubs, universities, and transportation lines command premium rents and have lower vacancy rates.

On the Mediterranean and Aegean coasts, cities like Antalya, Bodrum, and Fethiye offer lucrative opportunities in the short-term rental market. These regions attract millions of tourists annually, making vacation rentals a highly profitable venture, especially during the summer season. Well-maintained villas and beachfront apartments in tourist-heavy areas can yield significantly higher returns than long-term rentals.

The rise of digital nomads and remote workers also boosts rental demand in these regions. Properties that offer high-speed internet, co-working spaces, and flexible leasing terms are in high demand, allowing landlords to command premium prices.

Investors should consider diversifying their portfolio by mixing long-term rental properties in urban centers with short-term holiday homes in tourist areas. This strategy spreads risk and maximizes income potential throughout the year.

Understanding local rental regulations, taxes, and management requirements is crucial to optimizing rental income. Partnering with reliable property management firms can further enhance profitability and reduce the hands-on burden of managing rental properties.

Capital Appreciation in Emerging Markets

Capital appreciation remains one of the most compelling reasons to invest in Turkish real estate, especially in emerging markets within the country that are poised for significant growth. In 2025, savvy investors are eyeing cities and districts where infrastructure development, urban expansion, and economic growth are converging to drive property values upward.

Emerging urban centers like Bursa, Gaziantep, and Kayseri offer promising opportunities for capital appreciation. These cities benefit from government-led development projects, industrial expansion, and improved transportation links, making them attractive to both local buyers and investors.

In Istanbul, peripheral districts such as Başakşehir, Beylikdüzü, and Pendik are gaining popularity as new metro lines, highways, and residential complexes enhance accessibility and living standards. Early investment in these areas can yield significant returns as they mature into fully developed urban neighborhoods.

On the coast, areas near upcoming resorts or infrastructure projects—like airport expansions or new marinas—are hotspots for appreciation. For example, regions in North Cyprus, though politically sensitive, are drawing attention for their high growth potential and relatively low property prices.

Investors looking for capital appreciation should focus on factors such as:

Proximity to infrastructure projects.

Economic growth indicators.

Population trends and urban migration patterns.

Developer reputation and project quality.

Buying off-plan properties in these emerging markets can offer attractive entry prices and substantial gains upon project completion. However, due diligence is vital to mitigate risks associated with market volatility and project delays.

Forecast and Market Predictions for 2025 and Beyond

Expert Opinions and Market Analysis

Market analysts and real estate experts forecast a cautiously optimistic outlook for the Turkish property market in 2025 and beyond. The consensus suggests that while Turkey faces macroeconomic and political challenges, its real estate sector's fundamentals remain strong, buoyed by consistent demand, strategic location, and competitive pricing.

Key trends shaping expert forecasts include:

Continued foreign investment driven by attractive entry prices and the citizenship-by-investment program.

Urban transformation projects enhancing the appeal of secondary cities and suburban districts.

Technological integration in property transactions improving transparency and investor confidence.

Growing demand for sustainable developments, aligning with global environmental trends.

Resilience of the tourism sector, supporting short-term rental markets.

Real estate consultancy firms highlight Istanbul, Antalya, and Izmir as the safest bets for both rental income and capital appreciation. Meanwhile, Bursa and Gaziantep are gaining recognition among institutional investors seeking long-term growth.

However, experts also caution about potential risks, including political shifts, currency fluctuations, and global economic instability. They advise a balanced investment approach, focusing on diversification, due diligence, and professional market analysis.

Overall, while the market may face short-term volatility, Turkey’s real estate sector is projected to remain a robust investment avenue for the foreseeable future, especially for those adopting a long-term perspective.

Future Prospects for Residential and Commercial Segments

Looking ahead, both residential and commercial real estate segments in Turkey offer distinct yet promising prospects.

Residential Sector:

Urbanization and population growth will continue to drive demand for housing, particularly in major cities and emerging urban centers.

Affordable housing initiatives will support first-time homebuyers, while the luxury segment will benefit from continued foreign interest.

Technological advancements and sustainable building practices will redefine buyer expectations and property standards.

Commercial Sector:

The office space market will evolve with hybrid work models, increasing demand for flexible and high-tech office environments.

Retail spaces will shift towards experiential offerings, integrating shopping with leisure and entertainment.

The logistics and industrial sector will experience sustained growth, fueled by e-commerce expansion and Turkey’s strategic location.

Investors should keep an eye on government policies, infrastructure developments, and global economic trends, as these will significantly influence market dynamics. By aligning investment strategies with emerging trends and future prospects, stakeholders can maximize returns and minimize risks in Turkey’s evolving property market.

Tips for Buying Property in Turkey in 2025

Legal Considerations and Due Diligence

Entering the Turkish real estate market requires careful legal planning to safeguard your investment.

Key steps include verifying property ownership, ensuring the property has the necessary construction and occupancy permits, and confirming there are no outstanding debts or liens on the property.

Working with a qualified real estate lawyer is crucial. They provide peace of mind, protect your rights, and streamline the buying process — especially if you’re a foreign investor unfamiliar with Turkish regulations.

For a detailed guide on hiring a trustworthy real estate lawyer in Istanbul and understanding legal procedures, check out this must-read resource:

👉 Hire a Real Estate Lawyer in Istanbul — The Ultimate 2025 Guide

Working with Local Agents and Lawyers

Partnering with reputable local real estate agents and legal professionals is critical for a smooth property transaction in Turkey. Experienced agents provide valuable insights into the market, help identify investment opportunities, and assist with negotiations.

Benefits of working with local professionals include:

Access to exclusive property listings.

Accurate market evaluations and price comparisons.

Assistance with legal paperwork and bureaucratic procedures.

Guidance on taxation, residency permits, and investment incentives.

When selecting an agent or lawyer, verify their credentials, seek client testimonials, and ensure they have experience working with foreign investors. Transparent communication and a clear understanding of fees and services are key to avoiding misunderstandings.

Many foreign investors also choose to work with licensed property consultants who offer end-to-end services, including property search, legal assistance, and property management. These professionals act as a bridge between the investor and the local market, ensuring a hassle-free experience.

By building a reliable local team, investors can navigate the Turkish real estate landscape confidently and make informed decisions that align with their investment goals.

Conclusion

The Turkish property market in 2025 stands at the intersection of opportunity and transformation. With its strategic location, diverse property offerings, and resilient economy, Turkey continues to attract investors from around the world. From the bustling streets of Istanbul to the serene coasts of Antalya and the emerging hubs of Bursa and Izmir, the market presents opportunities for every type of investor.

While challenges such as political risks, currency fluctuations, and regulatory complexities persist, they are balanced by strong market fundamentals, growing demand, and innovative developments. The rise of sustainable projects, technological integration, and government incentives further enhance the market's appeal.

For investors willing to conduct thorough research, engage with local experts, and adopt a long-term perspective, Turkey’s real estate sector in 2025 offers not just profitable returns but also a chance to be part of a dynamic and evolving market landscape.

Frequently Asked Questions (FAQs)

1. What are the best cities to invest in Turkish property in 2025?

Istanbul, Antalya, Izmir, Bursa, and Gaziantep stand out as top investment destinations due to their growth potential, infrastructure development, and rental yield opportunities.

2. Is foreign ownership of property allowed in Turkey?

Yes, foreign nationals can own property in Turkey with minimal restrictions. However, certain areas may require special permissions due to security regulations.

3. How is the rental yield in Turkey compared to other countries?

Turkey offers competitive rental yields, particularly in Istanbul and tourist hotspots like Antalya and Bodrum, often exceeding 5-8% annually, depending on location and property type.

4. What taxes apply to foreign property buyers in Turkey?

Foreign buyers are subject to property transfer tax, annual property tax, income tax on rental income, and capital gains tax if selling within five years. Double taxation treaties may reduce some tax liabilities.

5. What should investors watch out for in the Turkish real estate market?

Investors should be mindful of political risks, currency fluctuations, legal complexities, and ensure they conduct proper due diligence with the help of experienced local professionals.

Have Question Or Suggestion ?

Please Share Your Thought, To Make It Real

.webp)

.webp)